Foreign companies in Hungary

Hungary’s central location in the heart of Europe makes it an ideal place for entering the EU market. The country has several more advantages for investors besides its favorable location, such as having excellent infrastructure, access to the single community market, and outstanding business opportunities in manufacturing, services, and logistics. Also, Hungarian labor is well-educated and relatively cheap.

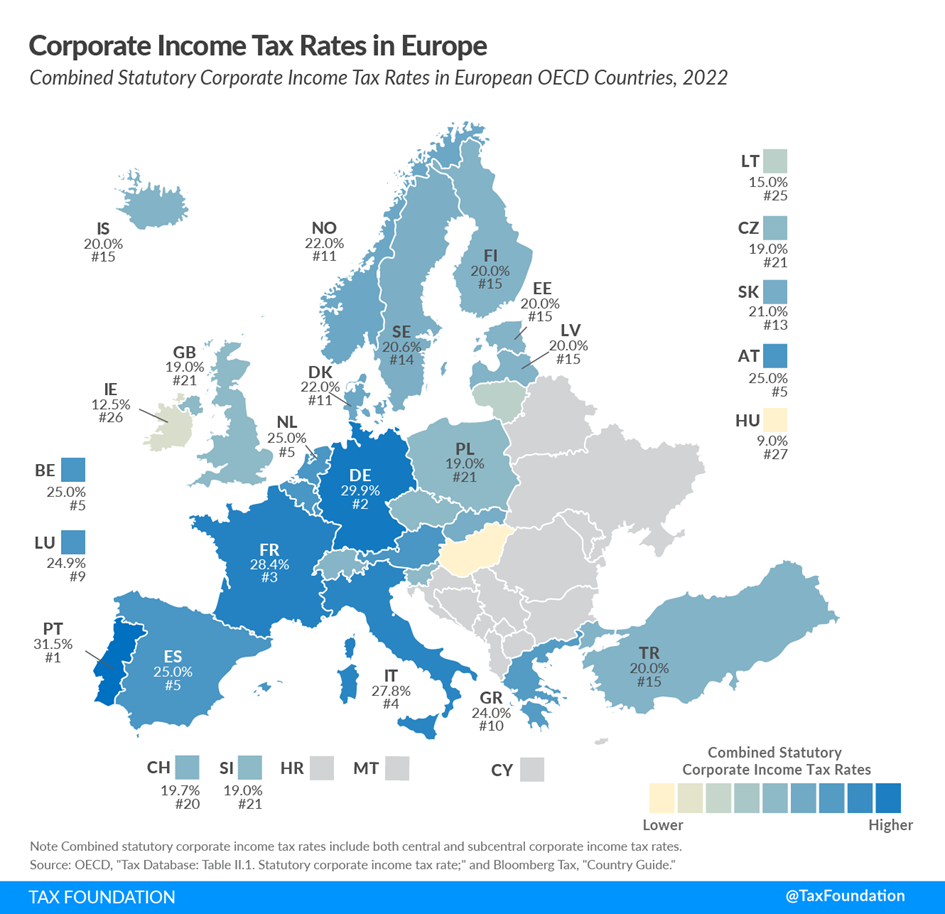

In addition to the geographical conditions, most investors choose Hungary because of its favorable tax regime.

In the European Union, Hungary has the lowest corporate tax rate (9%). Strenghtening the argument, the country has one of the most competitive tax systems in the EU.

.

Moreover, many EU tendering opportunities are available for companies that can be used to claim non-refundable and partially refundable cash grants.

Generally speaking, the legal environment is considered investor-friendly and foreign investors are always welcome.

Apart from these reasons, Hungary can be a good investment choice due to the quick and easy company formation procedure. Furthermore, foreign investors can also obtain an EU VAT number and a visa or residence permit within a short time.

Would you like to start a business in Hungary?

Feel free to contact us or read our other blog posts on this topic:

Do not hesitate to contact us

Get in touch, if you have any question